Lily in Year 13 wrote this article just before the start of Lockdown 2 in November 2020 in the UK. As we now gradually come out of Lockdown 3 some 7 months later, how much of the article rings true?

As of the 23rd March 2020 the UK was placed under lockdown and has been moving in and out of lockdowns and restrictions ever since. This is likely to cause an economic slowdown and possibly plunge the UK into recession over the coming years because when people are in lockdown consumption and aggregate demand in the UK is likely to fall. There will be impacts on workers and the UKs supply of goods domestically and from abroad which is also likely to negatively impact the economy. Overall, the UK and its economy is likely to suffer as a result of Covid-19.

Possible impacts

Firstly, aggregate demand in the UK will be hit by the virus as when people are quarantined they will be unable to go out and spend, especially as recently all shops selling non-essential goods along with bars and restaurants have been told to close meaning this spending in these sectors won’t be possible anymore. This will be added to by the low consumer confidence that is currently present as in uncertain times people save their money as a safety net so they will be able to support themselves in uncertain times.

Consumption patterns will also change, meaning goods with an income elasticity of demand between 0 and 1 are likely to see little change in demand as these goods are classed as necessities. Some might even see a rise in demand in the short term as people panic buy (think back to scenes of toilet roll panic buying in April 2020).

However, goods with an income elasticity over one are likely to see a decrease in demand as these are classed as luxuries so people won’t be prioritising purchasing these items when economics conditions are uncertain. This means that overall consumption will decrease as people don’t have the opportunity to spend as much out shopping or on luxuries and are also likely to be more cautious with their spending by nature. This fall in consumption will also be exacerbated if people’s incomes are negatively impacted, such as if they were previously working in the gig economy, perhaps on zero hour contracts or with irregular, situation-based income.

These people would be relying on their savings or help from the government for their money, meaning their spending and consumption is likely to fall. To encourage more spending the bank of England has dropped interest rates to a new record low 0.1% to encourage people to go out and spend instead of save as they will be receiving very little gain from letting their money sit in a bank account. Also, as if demand falls whilst there is still a constant level of supply prices of goods and services are likely fall. This can be seen through the drop in the price of flights as airlines suffer a shortage in demand. For example a flight from California to London would have previously cost $1000 can now be purchased for as low as $246 dollars. However, this drop in prices is likely to have a limited effect on demand because of the uncertainty currently which also means low interest rates are likely to have a limited effect in changing people’s behaviour. Recent travel bans will also limit the impact lower prices in the airline industry since people are unable to take advantage of these lower prices when they are unable to travel or will be deterred by quarantine times. This means that overall aggregate demand and consumption in the UK is likely to fall because there will be fewer opportunities for people to spend but mostly because of consumer uncertainty. This will negatively impact the UK economy.

Aggregate supply in the UK will also be impacted by the virus, impacting costs along with exports if less is being produced domestically. A fall in domestic supply could result in cost push inflation as if demand levels for some products remain steady prices would have to rise to make up for the limited stock or production due to covid-19 restraints on supply. This fall in supply could be caused if workers have to self-isolate and cannot go to work, meaning a company cannot operate at full capacity causing a shift inward on their PPF.

Companies might also have trouble receiving stock from other countries if their production has been impacted by the virus which could prevent production in domestic businesses. This is likely to hit the manufacturing industry especially hard as these rely on parts from abroad, such as the car company Jaguar which is now running out of parts it would usually ship from China[1], and people coming to work as it is very difficult to work from home if you worked in a factory. This effect on supply could be decreased depending as the UK has a flexible labour market, meaning people can easily move from job to job meaning businesses won’t be hit as hard by the shock as resources (people) can be reallocated more easily compared to France where the labour market is very inflexible.

This effect on supply also depends how flexible the product markets are as if a company could switch supplier there would be minimal effect especially if this new supplier was located domestically instead of abroad. There might also be a time lag if producers had stockpiled meaning it would take longer to run out of stock however is still likely to happen in the long term. In the long run this outbreak could cause LRAS curve to shift inwards if there is less investment as companies will be working harder to keep afloat rather than investing or spending on R&D meaning less will be invested into the countries long term productivity.

This can be seen though the fall in the share prices of the FTSE 100 as on 9th March 2020 the average prices of shares fell 8%[2], the worst day since the 2008 financial crisis with £144bn wiped off its combined value. These top 100 companies were likely to be some of the largest investment spenders. Although, as the UKs economy is mainly based on financial services, many can work from home meaning domestic supply issues may not affect the economy as much as countries that rely heavily on manufacturing such as China and Germany shown as Chinese economy shrank by 6.8% in the first quarter of 2020, the first contraction since 1976. The government could also reduce the effect on domestic supply by subsidising companies so they are able to invest in the technologies they need and keep production lines running, or as interest rates are low companies could take out a loan to invest. Meaning there are options for companies to try and uphold supply and investment. However, there is still the underlying issue of people not being able to go to work because of self-isolation. This will have a huge impact on supply in the UK and therefore the economy as if products aren’t being made they cannot be consumed and if they aren’t being consumed profits will fall leaving companies to have less money to invest, impacting supply in the short term along with productivity in the long term.

Overall, the impact of the virus is going to be wide-ranging across the world and in the UK, impacting both supply and demand. Impacts of the fall in supply in the short term will be slightly counteracted by the fall in aggregate demand as if both curves shift inwards there will be a new equilibrium point of production and cost push inflation is likely to be limited. However, the nation’s productivity and output will decrease which means the UKs GDP is likely to fall significantly, plunging the UK into a recession. The British government are spending more to combat some of the impacts however this is unlikely to cover the full economic impact and will see a rise in the government budget deficit as a result. This also makes it likely that we will see the government to following a policy of austerity over the coming years, meaning people in the UK and the UKs economy are likely to be hit hard by this crisis. However, as the virus is a global pandemic, it is likely that its impact will also be mirrored across the rest of the world.[3]

2021 Update

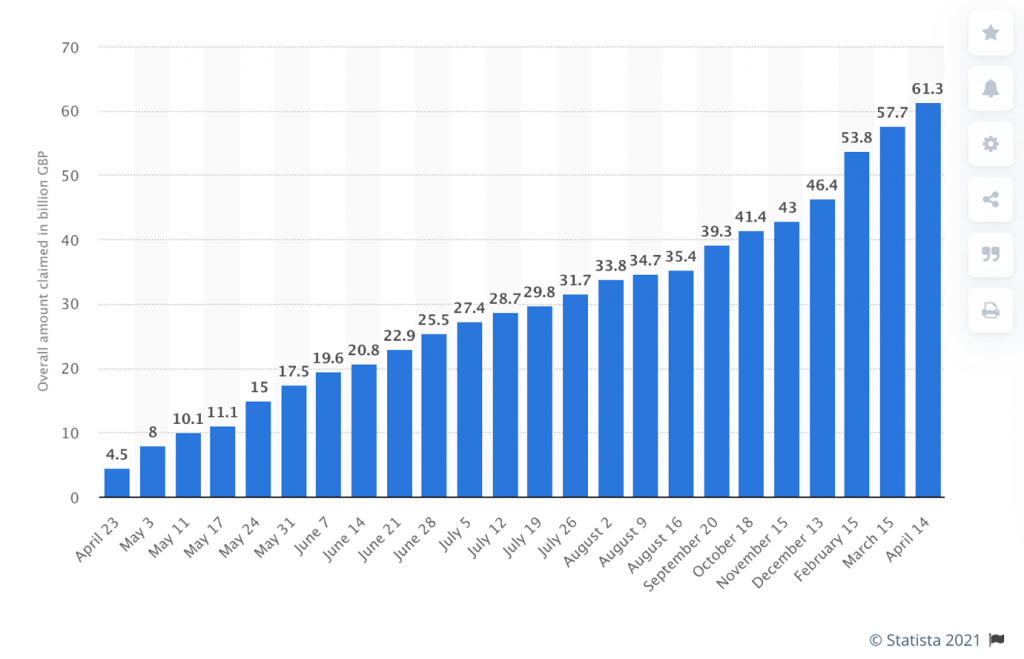

The UK Government introduced the furlough scheme to support workers and businesses who were unable to run as normal owing to the impact of the virus. Up to April 2021 this has cost over £61 billion[4], with 4.7 million jobs impacted. Government spending is at the highest figure ever seen outside of periods of war.[5]

With increasing numbers of the population having now been vaccinated against the virus, and the recently announced reopening of restaurants from 17 May 2021[6], there is a feeling that we are gradually moving out of the crisis and that normality is becoming closer.

However, the vast spending seen

since the crisis started in January 2020 will almost certainly mean that a

return to a pre-pandemic life will be a challenge and that further austerity

will be required to settle the books. The need to ‘level up’ the country, as

announced by the Prime Minister on 11 May 2021[7], will be central to life

as we know it for many years to come. Whether this can be achieved will be

subject to criticism and debate for the significant future.

[1] See https://www.independent.co.uk/news/business/news/coronavirus-jaguar-land-rover-suitcases-supply-chain-factories-china-a9343336.html

[2] See https://www.theguardian.com/business/2020/mar/09/ftse-plunges-to-below-6000-amid-global-coronavirus-sell-off-oil#:~:text=9%20March%202020%20Fears%20of,into%20an%20official%20bear%20market.

[3] See https://www.ons.gov.uk/economy/grossdomesticproductgdp/articles/coronavirusandtheimpactonoutputintheukeconomy/december2020#:~:text=6.,declined%20by%209.9%25%20in%202020.&text=GDP%20measured%20by%20the%20output,growth%20of%201.4%25%20in%202019. The impact on the UK economy is a 9.9% fall in GDP over the course of the year.

[4] Table and reference from https://www.statista.com/statistics/1122100/uk-cost-of-furlough-scheme/

[5] See https://www.bbc.co.uk/news/business-52663523

[6] See https://www.telegraph.co.uk/politics/2021/05/12/covid-lockdown-roadmap-new-rules-may-17-dates-when-end/

[7] See https://inews.co.uk/news/politics/queens-speech-2021-boris-johnson-pledges-to-harness-spirit-of-lockdown-as-he-sets-out-uks-covid-recovery-995558